Getting Started

Members Chat

Stocks Platform

Options Platform

News

Courses

Mobile App

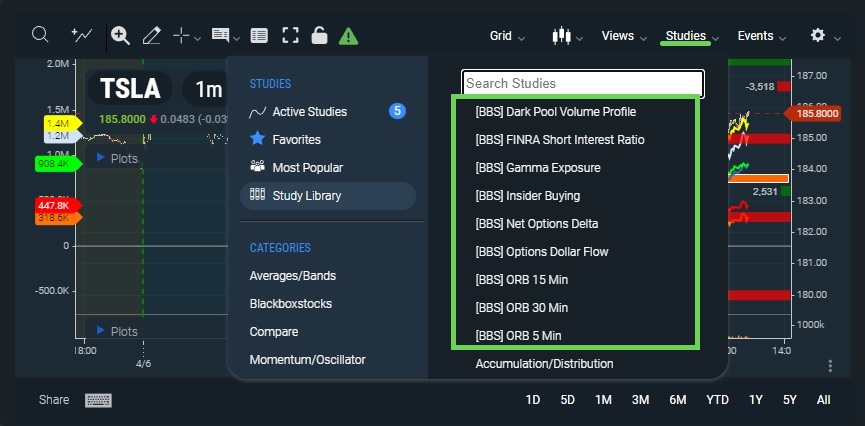

Our Proprietary Indicators: BlackBoxStocks Exclusive

Discover BlackBoxStocks’ proprietary indicators, enhancing trading strategies with exclusive market insights. Uncover our unique studies now!

BlackBoxStocks offers a suite of nine exclusive, proprietary indicators to help traders make well-informed decisions and enhance their trading strategies. These unique tools, referred to as studies, provide invaluable insights into market trends and equity movements. This page highlights our proprietary studies, giving you an overview of each one and its benefits.

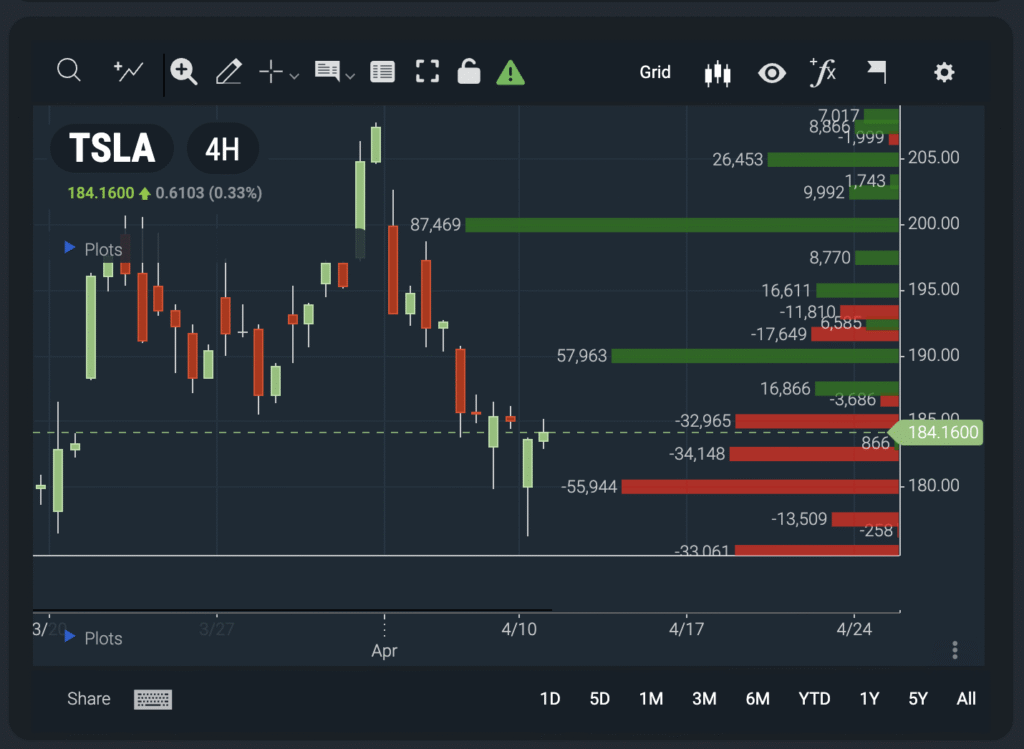

Dark Pool Volume Profile

The Dark Pool Volume Profile study offers insights into the trading activity in dark pools. Dark pool trades are regulated and have to be reported to the public exchanges. Dark Pools enable large traders to conceal their intentions until the trades are executed and reported. By analyzing dark pool trading data, traders can gain a better understanding of institutional activity and identify potential price movements.

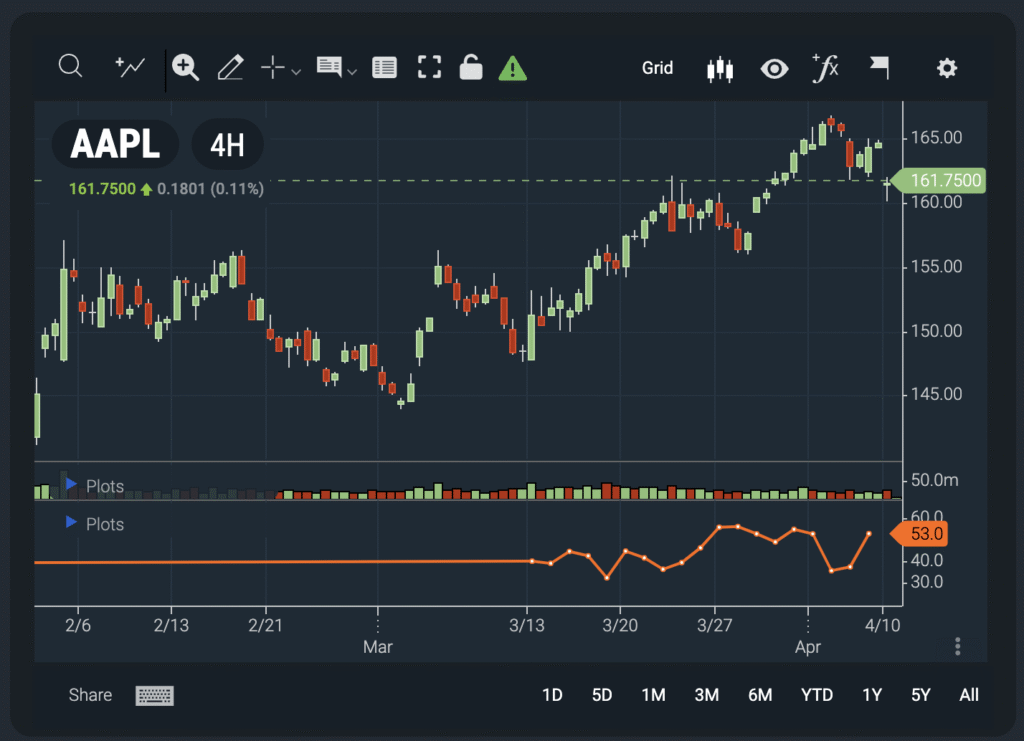

FINRA Short Interest Ratio

The FINRA Short Interest Ratio study reveals the ratio of short interest to total shares outstanding for a particular stock. This ratio is an important indicator of market sentiment and helps traders identify stocks that may experience short squeezes or potential price declines.

Gamma Exposure

The Gamma Exposure study measures the sensitivity of an option’s delta to changes in the underlying asset’s price. By monitoring gamma exposure, traders can anticipate potential price movements, manage risk, and identify optimal entry and exit points for their trades.

Insider Buying

The Insider Buying study tracks the buying activity of a company’s insiders, such as executives and board members. This data can be a valuable signal for traders, as insider buying may indicate a positive outlook for the company and its stock price.

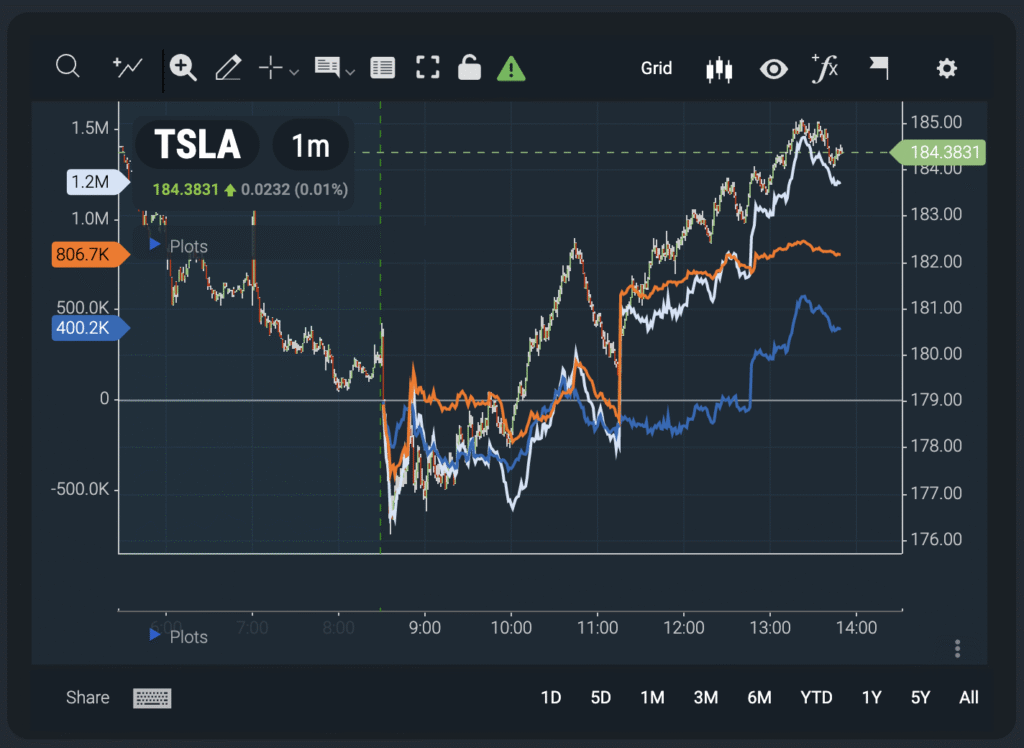

Net Options Delta

The Net Options Delta study calculates the difference between the total delta of call options and the total delta of put options. This measure can help traders identify potential directional trends in the market and better understand the overall sentiment of the options market for a specific equity.

Options Dollar Flow

The Options Dollar Flow study measures the inflow and outflow of money in the options market for a particular stock. By analyzing options dollar flow, traders can gauge market sentiment and identify potential trading opportunities.

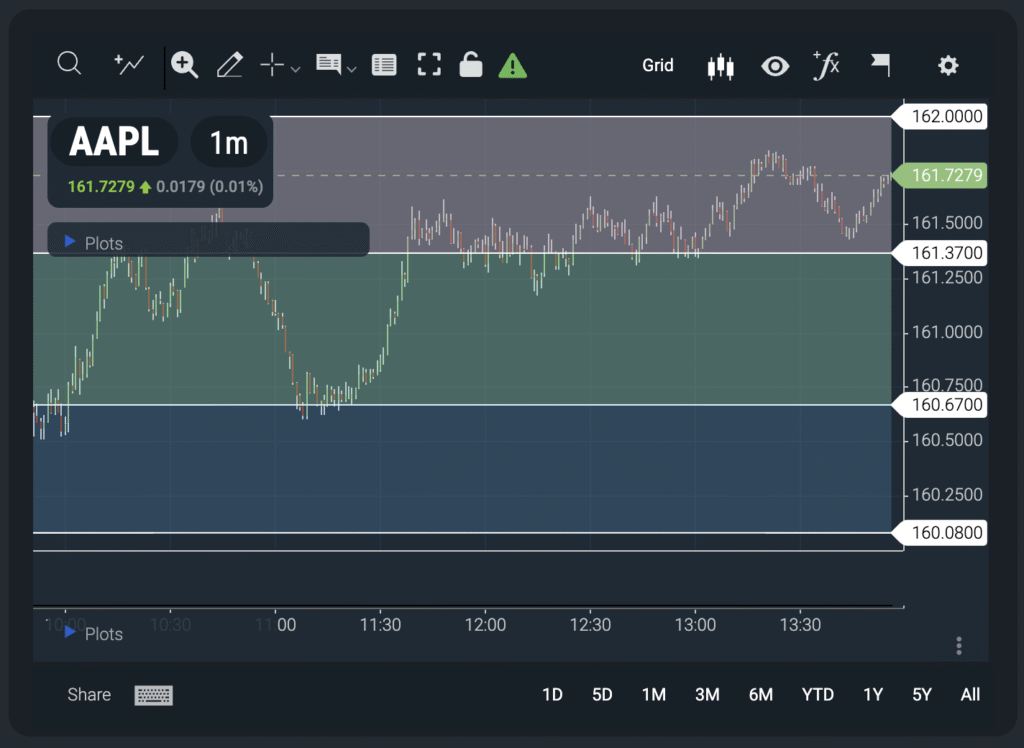

ORB 15 Min, ORB 30 Min, and ORB 5 Min

The Opening Range Breakout (ORB) studies are designed to help traders capitalize on early market movements. These studies identify breakouts that occur within the first 5, 15, or 30 minutes of the trading session. By monitoring these breakouts, traders can identify potential entry and exit points for their trades and capitalize on market momentum.

BlackBoxStocks offers a range of exclusive proprietary indicators to help traders make more informed decisions and enhance their trading strategies. By understanding and utilizing these studies, you can gain a competitive edge in the market and improve your trading success.