Getting Started

Members Chat

Stocks Platform

Options Platform

News

Courses

Mobile App

Options Flow Filters

The Options Flow Filters feature on the BlackBoxStocks Options Platform provides traders with a powerful tool to quickly analyze and identify relevant options trading data based on their specific needs and trading strategy. By applying various filters, users can eliminate market noise and focus on the most important options activity. Here are some of the key filters available on the platform:

Option Type – Check the boxes for the type of option you want to include (Put, Call, or both), uncheck for those you want to exclude.

Flow Colors – Only want to see Yellow colored trades? Check the Yellow box and uncheck the others.

Bid/Ask – This one can sometimes be confusing. To make the system easier to use for new traders, we select ‘At or Above Ask’ by default so that you will see all Ask side activity. As you become more familiar with options flow, you may want to check ‘At or Below Bid’ as well so you can see both Ask side and Bid side activity. If you want to see all trades, including limit orders, unselect all of the boxes. Then you will see flow trades marked as A, AA, B, BB, and no designator (limit order executed between the bid and the ask).

Details – In this section, you can add multi-leg trades, filter by the per share price of the contract, or by the number of contracts traded.

Multi-leg trades are trades such as strangles, straddles, spreads, or any trade comprised of multiple components. When you check the Multi-leg box, multi-leg trades will be visible in the flow with ‘ML/’ in the TYPE column. By default, we only include Sweep and Block trades in the flow. Multi-leg trades are placed by advanced options strategy traders seeking to lower their risk in exchange for lower potential profits.

Examples of other Details: To see trades where the per share contract price is $0.50 or less, check the ‘<= .50’ box. To see all trades with 5,000 or more contracts traded, select the ‘>=5000 Contracts’ box.

Security Type – We enable ‘Stock’ trade by default. If you want to see trades on the SPY, QQQ, and other ETFs, check the ETF box. Note, there is massive options volume on the SPY and the QQQ so if you enable ETF trades, your options flow will stream by very quickly on the platform. To slow down the flow feed, turn off ETFs or run a separate instance of BlackBox with only ETF selected.

Value (Premium) – Here you can filter flow by the size of the trade. If you are looking for all trades above $500K in value, select the ‘>=$500,000’ box. Note, if you do not select any of the Value boxes, you will see all flow trades that meet BlackBox’s minimum criteria. Do not select more than one Value filter because multiple trade value selections can cross each other out which will omit data you are looking for.

The ‘<$0.75T Mkt Cap’ is designed to omit flow for all companies with a market cap 3/4 of a trillion dollars.

Other – Use these filters for options moneyness (ITM and OTM), Sweep trades, weekly expirations, flow trades the day a company is reporting earnings, flow defined as ‘Unusual’ based on our criteria, and Ex-Dividend flow. By default, we do not show options flow for stocks going ‘ex dividend’ the next day. Ex dividend options flow can trade very heavily and be difficult to decipher. We display the Dividend Date in the banner above the chart in the ‘Dividend Date’ section so if you do not see flow for a particular stock, check the Dividend Date.

These filters are ‘stackable’ meaning you can choose multiple criteria such as ‘In The Money’ + ‘Sweep Only’ +’Weekly’ to see all in the money sweeps with the current week’s expiration.

Sectors – All sectors are enabled by default. If you want to exclude a sector you aren’t interested in trading from the flow, simply uncheck the box for that sector.

Expiration – Use this filter to see only options trades with a specific expiration date or date range. Remember, options on equities have Friday expirations (unless Friday is a holiday and then it will be a Thursday expiration), while ETFs like the SPY and QQQ have daily expirations. Don’t set the Expiration filter for today’s date if today is a Wednesday and you are wanting to see stock options flow. Also, make sure to select ‘Start’ and ‘End’ dates.

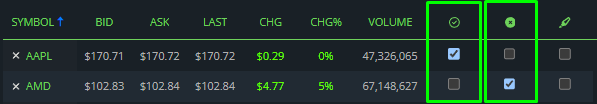

Watch List – Use these filters to include (‘Only’) or exclude (‘Omit’) flow based on your Watch List. Activating this function is a two-step process. First, set up your Watch List under the Watch List tab and select the stocks you want to see in the options flow (use the green checkmark icon for ‘ONLY’) and stocks you want to remove from the flow (use the ‘X’ icon for ‘OMIT’) .

Then, select the Watch List filters in the Options Flow Filters to ‘Omit’ flow for stocks you have selected or ‘Only’ show flow for stocks you have selected.

The Options Flow Filters feature on the BlackBoxStocks Options Platform is designed to help traders efficiently navigate the vast array of options data and focus on the most pertinent information for their trading strategies. By applying the appropriate filters, you can streamline your decision-making process, identify potential opportunities, and increase your chances of success in the options market.